The New Way to Finance Large Purchases

Selina Finance is a pioneering financial services company that helps homeowners upgrade their lifestyle sooner. Selina introduced the first Home Equity Line of Credit (HELOC) in the UK, a flexible and affordable credit facility secured against property. This innovation allows homeowners to leverage the equity in their homes to finance significant purchases and consolidate debt.

Why Choose Selina Finance?

Selina Finance stands out for its innovative approach and commitment to providing flexible financial solutions. Key benefits include:

- Upgrade Sooner: Access funds to improve your lifestyle, whether it’s for a better car, a new kitchen, private education, or better holidays.

- Pioneers in the UK: The first to offer HELOC in the UK, modelled after successful systems in the US, Canada, and Australia.

- Experienced Team: A growing team with decades of experience in financial services, based in London and Manchester.

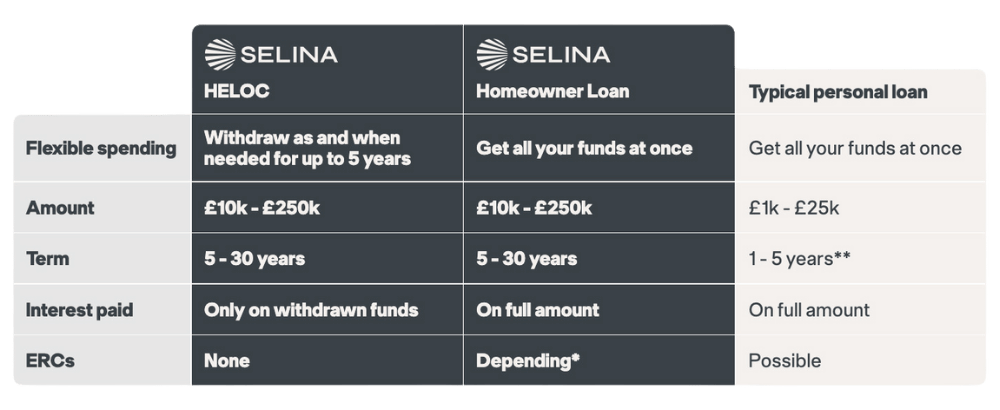

Used responsibly, a Selina HELOC and a Selina Homeowner Loan can provide you with valuable advantages. However, as they are mortgages, you should consider the possible impact on your ability to secure additional borrowing against your home.

*ERCs can apply depending on the Homeowner Loan product that you get.

**Whilst from our research personal loans are generally offered over 1-5 years, some lenders do offer longer terms.

Selina HELOC (Home Equity Line Of Credit)

The Selina HELOC is the most flexible option available, allowing homeowners to draw down funds as needed over the first five years. Interest is only paid on the funds drawn, providing peace of mind and financial flexibility.

- Key Features:

- Flexible drawdown and repayment options

- Only pay interest on the amount drawn

Selina Homeowner Loan

For those who need all their funds upfront, the Selina Homeowner Loan provides a lump sum secured against the property. This option is ideal for homeowners who need the borrowing in one go.

Use Cases

Debt Consolidation: Selina Finance offers secured loans perfect for debt consolidation. Homeowners can simplify their finances by merging multiple high-interest debts into one manageable monthly repayment at a lower interest rate.

New Vehicle Purchase: Selina Finance provides loans for purchasing new vehicles, with flexible options to draw down funds as needed or get all the funds on day one.

Buy-to-Let Property: They also offer loans to cover deposits and pay for renovations for buy-to-let properties. Homeowners can benefit from flexible drawdown options or a fixed amount upfront.

Why Consolidate Your Debts?

Debt consolidation with Selina Finance simplifies monthly repayments, offers lower costs and longer terms, and provides certainty with fixed payments. Homeowners can leverage larger loan amounts to pay off debts and upgrade their lifestyle.

- Simplify Your Finances: One seamless, consolidated payment for ease and clarity.

- Certainty with Fixed Payments: Predictable and consistent payments each month.

- Lower Costs, Longer Terms: Potentially lower interest rates and spread payments over a longer period.

- Extra Spending Money: Use larger loan amounts to improve your home, pay school fees, go on holiday, or buy a new car.

The last word

Selina Finance is a trailblazer in providing innovative financial solutions for homeowners. With flexible HELOCs and homeowner loans, Selina enables homeowners to upgrade their lifestyle sooner, manage debt more effectively, and make significant purchases affordably. You can now explore how Selina Finance can help you achieve your larger purchases, today.