Home » For Brokers » Property Finance » Mezzanine Finance

Mezzanine Finance

Source the best Mezzanine Finance for your client, with access to over 200 specialist lenders.

No Joining Fees. No Membership.

200+ Lenders

Specialist Advice

No Membership Fees

Best Rates

Mezzanine Finance With Provide Finance

Mezzanine finance is one area of specialist finance that, while complex, can be a useful tool – provided you can negotiate the right terms.

Your client can utilise mezzanine finance as a second charge on top of a first charge. Typically, its role is to fill the gap between the finance being provided by a primary development lender, and the deposit a developer has available. This gives developers maximum flexibility, ensuring you can complete the development successfully without needing to tie up all of your liquidity in a deposit.

However, this is not the only route forward to access more liquidity; if you require additional funding, you may wish to explore options around stretched senior debt, as well as mezzanine finance. It’s this nuanced area of understanding where Provide Finance thrives.

It’s also important to note that mezzanine finance is generally more expensive than primary development finance; as mezzanine finance providers take on greater risk being a form of second-charge loan. That’s why it’s crucial to find the best financing rates to help your client succeed.

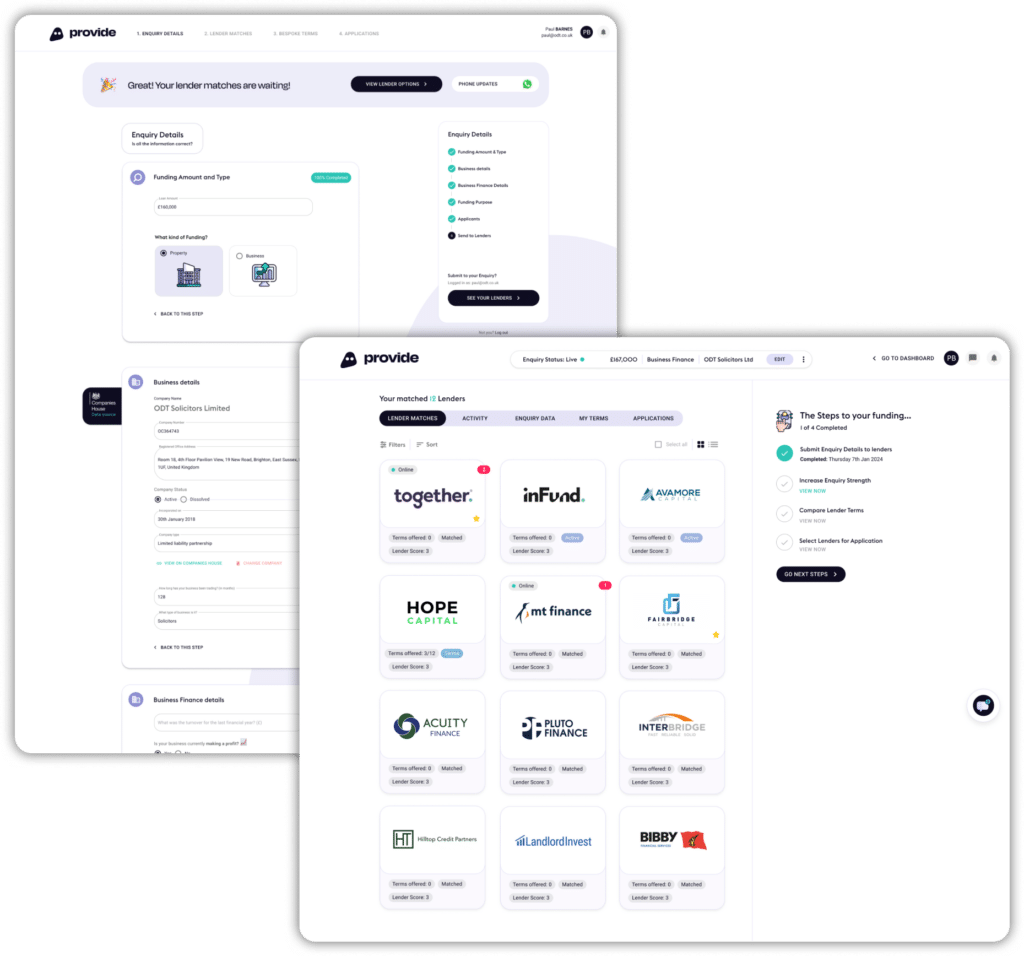

Using our smart-search platform and supporting team of specialist advisors, you can place any deal through Provide Finance, with no upfront fees, only generating a fee from the lender upon completion of your deal.

Get started today by opening your free account.

Why Choose Us?

Create Virtual Applicants

Manage your customers needs by creating applicant details in the platform.

Match With Lenders

Our sophisticated matching engine finds the best lenders.

Manage Multiple Enquiries

Our dashboard allows you to view the status of all your enquiries at a glance.

Upload & Send Documents

Secure file transfer allows you to submit and receive documents through the platform.

Control Loan Status

You have control over the status of the loan at all times, pausing to suit you.

Chat Directly to Lenders

Alerts, notifications and direct chat allow you to keep all communications in one place.

Connect with over 200 trusted lenders

How It Works

Submit Enquiry

Click ‘Open Free Account‘ and submit your enquiry.

Matching Engine

Our software matches you with our specialist business finance lenders.

Connect With Lenders

Engage directly with our lenders and view your deals progress in real-time.

Chat To Support

We offer step-by-step support to help you get the best deal possible. Use our live chat, or call 0800 772 3180.

Together, We Go Far

At Provide Finance, we’re reshaping the future of mezzanine finance.

With our award-winning blend of innovation and expertise, we seamlessly connect brokers and intermediaries with lenders.

Our solutions are fast and cost-effective, providing you with transparency, control, and tailored support. With Provide Finance, you gain control through a real-time dashboard that tracks your applications, enabling you to achieve your clients objectives with peace of mind. Provide Finance is dedicated to easing the complexities of specialist financing, to prioritise your, and your clients’, success.

What Our Clients Say

Find Your Funding Now

Provide Finance instantly matches your enquiry with a highly targeted list of lenders, ready to finance your clients’ specific loan type. Compare, match and control your application, fully supported by our team of financial experts, today.

Find Out More

* Average Loan Completion refers to our average bridging loan approval period.