Commercial Bridging Finance in the UK

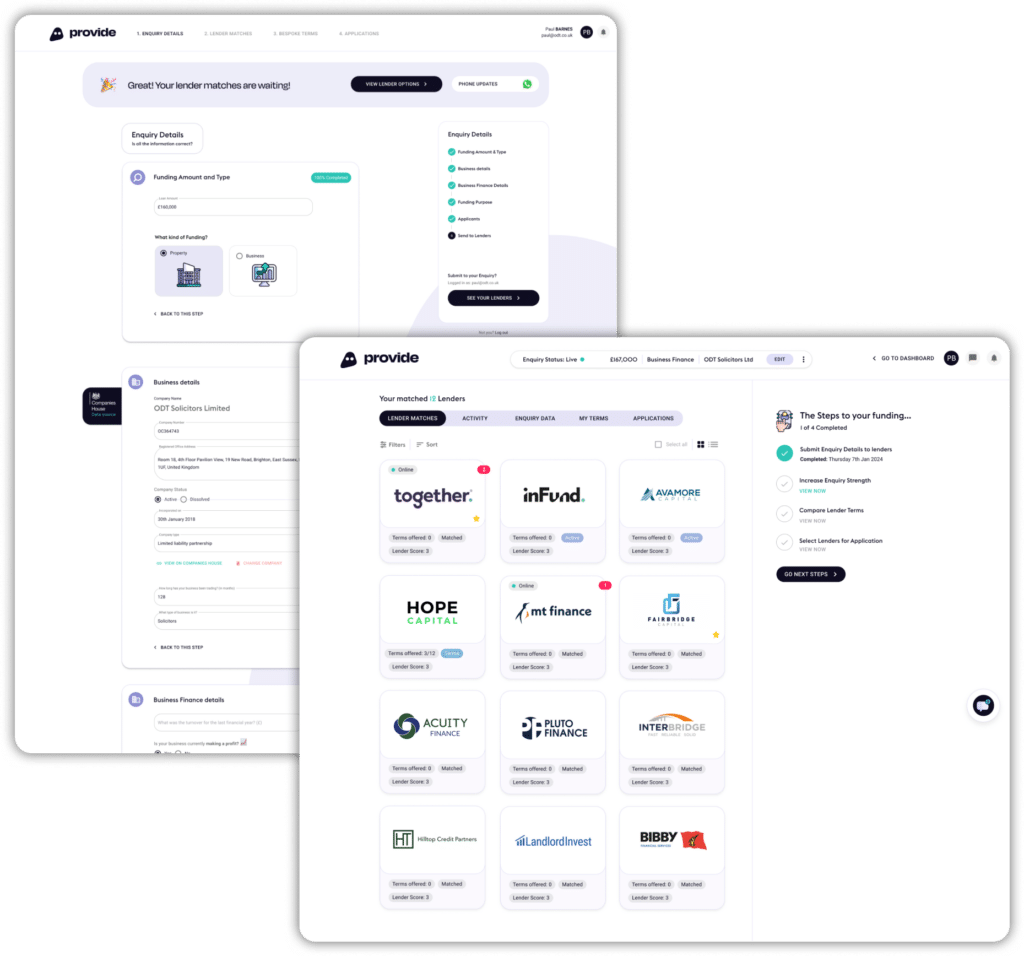

We combine technology and expertise to help you find the best commercial bridging finance in the UK with full market transparency and real-time dashboard control over your application.

Match With Lenders Today

Match With Lenders Today

200+ UK Lenders

Specialist Advice

Online Support

Best Rates

Fast Commercial Bridging Finance With Provide Finance

Commercial bridging finance is a form of short-term funding secured against property. These specialised bridging loans are designed to ‘bridge the gap’, giving businesses across the UK quicker access to funding and helping you capture valuable opportunities before anyone else.

Whether you’re buying at auction, looking to purchase commercial property, or need to fund a development project anywhere in the UK before you’ve sold your existing premises – commercial bridging finance can be your solution.

Provide Finance helps you get the funding you need, fast. With access to over 200 approved UK lenders, all with competing rates, we can put your enquiry in front of a range of pre-approved providers. You can screen, shortlist, and choose the best offer for your circumstances. Find out more today and start matching with lenders.

Why Choose Us?

Speed

Instantly match with specialist lenders that are pre-qualified and ready to fund your plans.Access

Our platform gives you access to over 200 bespoke lending options for your UK bridging loans, tailored to your requirements.

Value

Our smart-search software means you’re guaranteed the best rates in the market. Plus, we don’t charge a broker fee.

Support

Monitor your enquiry in real-time, while receiving specialist support from our expert team of advisers.

- Commercial Bridging Loan Rates and Costs Explained

- Lending Criteria and Eligibility

- The Commercial Bridging Loan Exit Strategy

Understanding the full cost of finance is essential. Commercial bridging finance rates in the UK are typically higher than traditional mortgages due to the short-term, high-speed nature of the loan. While interest rates often range from 0.75% to 1.5% per month, the final cost is calculated based on the project’s risk. Key fees to consider include:

Lender Arrangement Fee: A one-time charge, typically 1% to 2% of the loan amount.

Valuation Fee: Paid to a surveyor to assess the property’s security.

Legal Fees: Covering the cost of both the borrower’s and the lender’s solicitors.

Exit Fee: Some lenders charge a fee upon final repayment, often 1% of the gross loan amount.

This specialist guide on Commercial Bridging Finance in the UK has been reviewed and endorsed by Christopher Hollands, a leading figure in the commercial finance sector with over 20 years of experience in the industry.

Unlike traditional bank lending, securing UK commercial bridging finance relies more on the asset and the exit plan than just your business’s trading history. Lenders look closely at two primary factors:

Loan-to-Value (LTV) Ratio: Lenders typically fund up to 75% of the property’s current value.

Developer Experience: While first-time developers may be considered for smaller loans, larger projects often require a proven track record.

Our platform simplifies this by instantly matching your profile to lenders whose criteria align with your specific circumstances, ensuring you meet the requirements for fast approval.

The Exit Strategy is the most critical element of any commercial bridging finance in the UK application. It is your formal plan for how you will repay the loan principal and interest within the agreed-upon term (typically 6-18 months). The two most common exit routes are:

Refinancing: Moving the debt to a long-term commercial mortgage or Buy-to-Let product once the property is ready for occupation/renting.

Sale: Selling the property, either after refurbishment or development is complete.

Without a robust, verifiable exit strategy, lenders cannot approve the loan.

Connect with over 200 trusted UK lenders

How It Works

Submit Enquiry

Click ‘Match with Lenders‘ and submit your enquiry.

Matching Engine

Our software matches you with our specialist business finance lenders in the UK.

Connect With Lenders

Engage directly with our lenders and view your deals progress in real-time.

Chat To Support

We offer step-by-step support to help you get the best deal possible. Use our live chat, or call 0800 772 3180.

Together, We Go Far

At Provide Finance, we’re reshaping the future of commercial bridging finance in the UK.

With our award-winning blend of innovation and expertise, we seamlessly connect borrowers, lenders, and intermediaries.

Our solutions are fast and cost-effective, providing you with transparency, control, and tailored support. With Provide Finance, you gain control through a real-time dashboard that tracks your project’s funding, enabling you to achieve your objectives with peace of mind. Provide Finance is dedicated to easing the complexities of specialist financing, to prioritise your success.

What Our Clients Say

Frequently Asked Questions (FAQs)

About Commercial Bridging Finance & Loans in the UK

Commercial bridging finance is a short-term funding solution used by UK businesses to secure property or land quickly. It “bridges” the financial gap until longer-term financing is arranged.

Commercial Bridging Loans UK are structured as short-term finance, with standard terms typically ranging from 6 to 18 months. The key is having a viable exit strategy (such as selling the property or refinancing). While extensions may be possible depending on the lender and the project’s progress, they are generally not guaranteed and often incur additional fees. It is always recommended to plan for repayment well within the initial agreed-upon term.

Yes, we work with a panel of over 200 lenders that provide commercial bridging loan across the entire United Kingdom, including England, Scotland, Wales, and Northern Ireland.

Rates can vary depending on the lender and the specifics of your project. Our platform ensures you are matched with lenders offering the most competitive rates for your circumstances in the current UK market.

Speed is the primary advantage. While traditional mortgages can take months, the application process for commercial bridging loans in the UK is much faster because lenders focus on the property’s value and your exit strategy. With a clear plan and the right documents, funding can often be arranged in a matter of days, typically from 7 to 14 days, allowing you to seize opportunities without delay.

Yes, it is often possible. Unlike high-street banks that focus heavily on your credit score, bridging loan lenders place more weight on the value of the property you’re offering as security and the strength of your exit strategy. While severe credit issues might influence the interest rate you’re offered, a less-than-perfect credit history is not automatically a barrier to securing a commercial bridging loan.

Commercial Bridging Finance in UK is typically secured against a wide range of commercial and semi-commercial assets. This includes non-residential properties such as:

Commercial Offices and Retail Units

Warehouses and Industrial Units

Mixed-Use Properties (part residential, part commercial)

Development Land (with or without planning permission)

The property’s value and marketability are key factors, and the process is often faster and more flexible than a traditional commercial mortgage.

While there is no fixed upper limit, the maximum amount available for Commercial Bridging Loan in the UK is primarily determined by the project’s Loan-to-Value (LTV) and Loan-to-Cost (LTC) ratios. Lenders will typically offer up to 75% of the property’s current value (LTV) or 90% of the project’s total cost (LTC), depending on the experience of the developer and the quality of the exit strategy. We work with our panel of lenders to secure funding from $50,000 up to $25 million or more for major UK development projects.

Find Your Funding Now

Provide Finance instantly matches your enquiry with a highly targeted list of UK lenders, ready to provide your commercial bridging finance. Compare, match and control your application, fully supported by our team of financial experts, today.

Access The Best Deals

* Average Loan Completion refers to our average bridging loan approval period.