Home » Borrowers » Business Finance » Medium-Term » Unsecured Loans – Home Owner

Unsecured Loans - Home Owner

Let Provide Finance support you obtain an unsecured loan, as a home owner – over 200 lenders to choose from

Match With Lenders Today

Match With Lenders Today

200+ Lenders

Specialist Advice

No Broker Fees

Best Rates

Unsecured Loans for Home Owners With Provide Finance

Why Choose Us?

Speed

Instantly match with specialist lenders that are pre-qualified and ready to fund your plans.Access

Our platform gives you access to over 200 bespoke lending options, tailored to your requirements

Value

Our smart-search software means you’re guaranteed the best rates in the market. Plus, we don’t charge a broker fee.

Support

Monitor your enquiry in real-time, while receiving specialist support from our expert team of advisers.

Connect with over 200 trusted lenders

How It Works

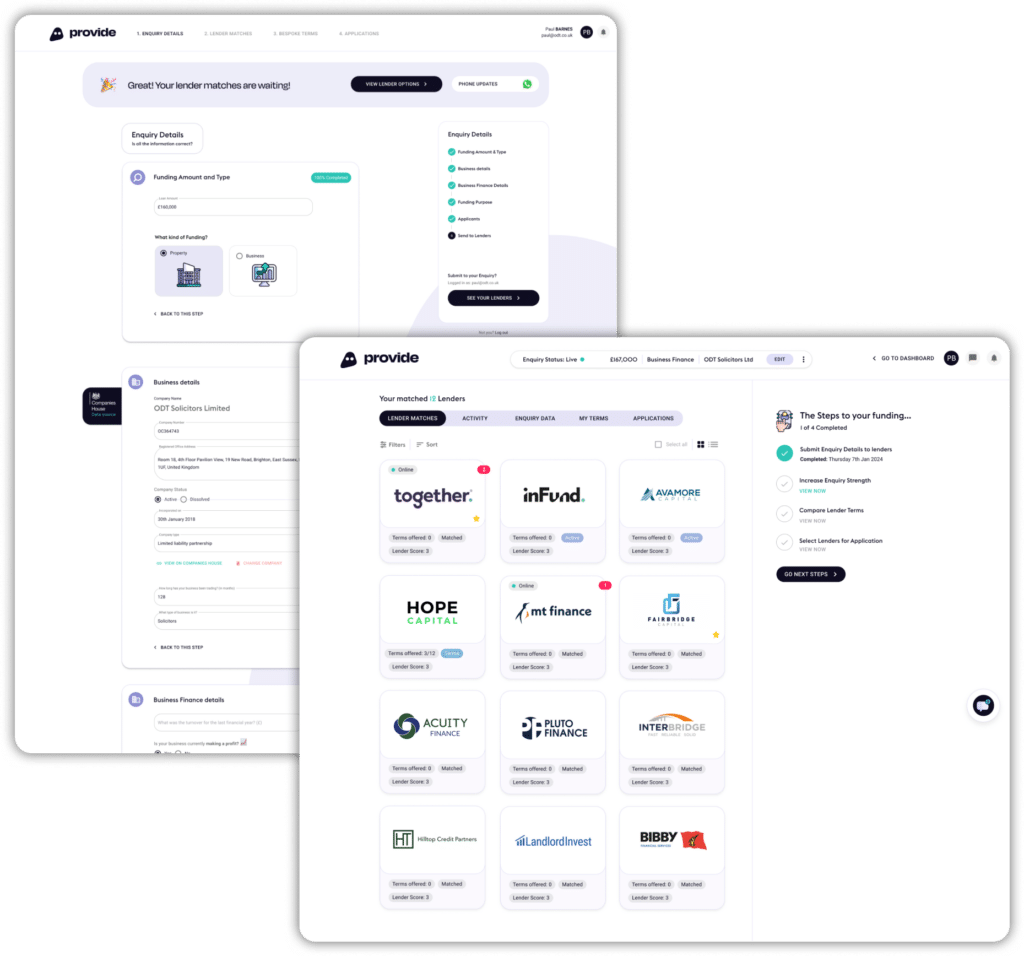

Submit Enquiry

Click ‘Match with Lenders‘ and submit your enquiry.

Matching Engine

Our software matches you with our specialist business finance lenders.

Connect With Lenders

Engage directly with our lenders and view your deals progress in real-time.

Chat To Support

We offer step-by-step support to help you get the best deal possible. Use our live chat, or call 0800 772 3180.

Together, We Go Far

At Provide Finance, we’re reshaping the future of finance.

With our award-winning blend of innovation and expertise, we seamlessly connect borrowers, lenders, and intermediaries.

Our solutions are fast and cost-effective, providing you with transparency, control, and tailored support. With Provide Finance, you gain control through a real-time dashboard that tracks your project’s funding, enabling you to achieve your objectives with peace of mind. Provide Finance is dedicated to easing the complexities of specialist financing, to prioritise your success

What Our Clients Say

Find Your Funding Now

Provide Finance instantly matches your enquiry with a highly targeted list of lenders, ready to finance your specific loan type. Compare, match and control your application, fully supported by our team of financial experts, today.

Access The Best Deals

* Average Loan Completion refers to our average bridging loan approval period.