Home » Borrowers » Business Finance » Medium-Term » MBO/MBI Finance

MBO & MBI Finance

Let Provide Finance support you if you’re seeking to find funding for ownership business changes

Match With Lenders Today

Match With Lenders Today

200+ Lenders

Specialist Advice

Online Support

Best Rates

MBO & MBI Finance With Provide Finance

Management Buyouts (MBOs) are often triggered when the founder of a business wants to retire, and the company’s managers acquire all or a large part of the company’s shareholding from the current owner.

However, MBOs also occur when a parent company wants to dispose of part of its business. MBOs typically require financial resources beyond those of management, such as bank debt or bonds. A Management Buy-In (MBI) is a corporate action where an outside manager or management team purchases a controlling ownership stake in an outside company and replaces its existing management team. This type of action can occur when a company appears to be undervalued, poorly managed, or requires succession. While a management buyout can represent an excellent opportunity for a company’s management team, often a substantial sum is required to finance the transaction.

The make-up of management buyout (MBO) finance can be quite complex and often consists of a mixture of debt and equity finance, with numerous parties involved.

We can help you to find the funding for your MBO activity. With considerable experience in the MBO/MBI arena, we have access to a wide range of lenders to provide you with the right funding support for your acquisition and beyond.

Why Choose Us?

Speed

Instantly match with specialist lenders that are pre-qualified and ready to fund your plans.Access

Our platform gives you access to over 200 bespoke lending options, tailored to your requirements

Value

Our smart-search software means you’re guaranteed the best rates in the market. Plus, we don’t charge a broker fee.

Support

Monitor your enquiry in real-time, while receiving specialist support from our expert team of advisers.

Connect with over 200 trusted lenders

How It Works

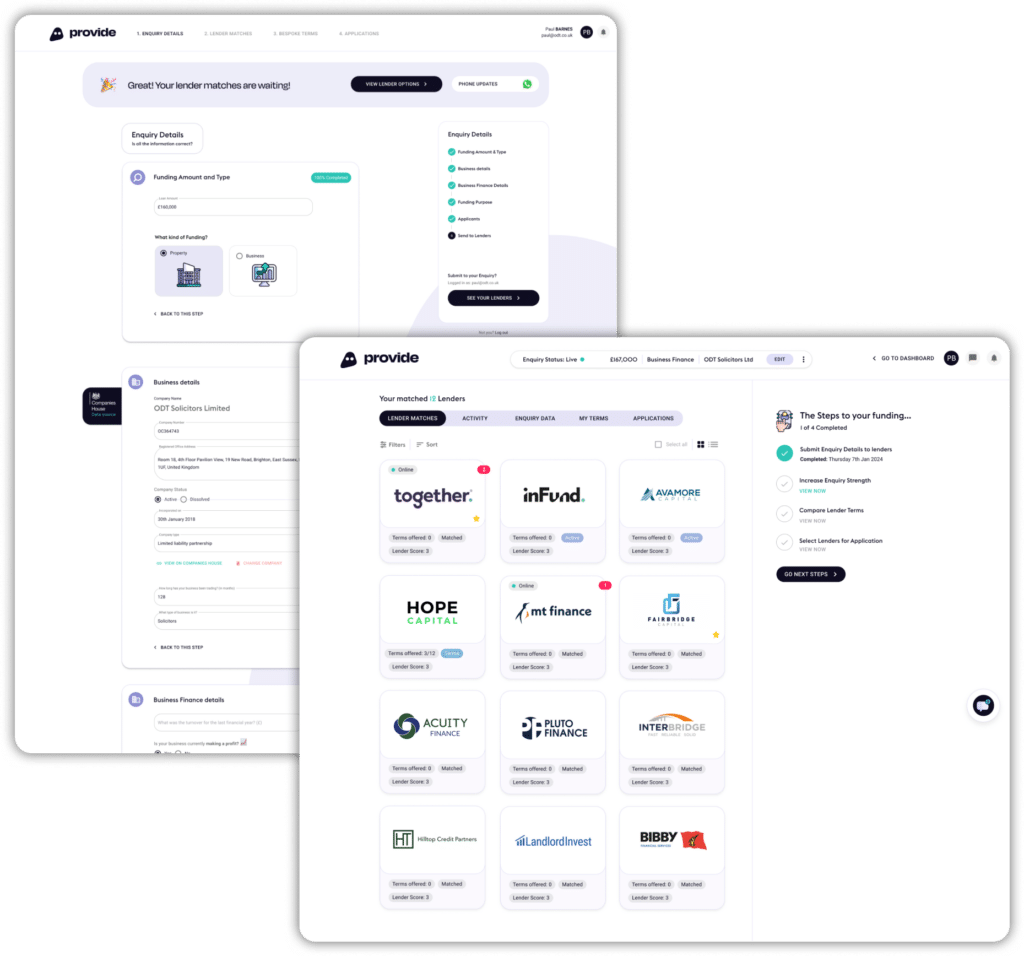

Submit Enquiry

Click ‘Match with Lenders‘ and submit your enquiry.

Matching Engine

Our software matches you with our specialist business finance lenders.

Connect With Lenders

Engage directly with our lenders and view your deals progress in real-time.

Chat To Support

We offer step-by-step support to help you get the best deal possible. Use our live chat, or call 0800 772 3180.

Together, We Go Far

At Provide Finance, we’re reshaping the future of MBO finance.

With our award-winning blend of innovation and expertise, we seamlessly connect borrowers, lenders, and intermediaries.

Our solutions are fast and cost-effective, providing you with transparency, control, and tailored support. With Provide Finance, you gain control through a real-time dashboard that tracks your project’s funding, enabling you to achieve your objectives with peace of mind. Provide Finance is dedicated to easing the complexities of specialist financing, to prioritise your success.

What Our Clients Say

Find Your Funding Now

Provide Finance instantly matches your enquiry with a highly targeted list of lenders, ready to finance your specific loan type. Compare, match and control your application, fully supported by our team of financial experts, today.

Access The Best Deals

* Average Loan Completion refers to our average bridging loan approval period.