Home » Borrowers » Business Finance » Short-Term » Business Overdraft Credit Facilities

Business Overdraft Credit Facilities

Match With Lenders Today

Match With Lenders Today

200+ Lenders

Specialist Advice

Online Support

Best Rates

Business Overdraft Credit Facilities With Provide Finance

A business overdraft can act like a short-term safety net when your business’s cash flow needs additional support, particularly with seasonal peaks…and troughs in mind. it provides the flexibility you need to plan for changes over the short term. Simple, flexible access to borrowing…only pay interest on the balance you’ve used.

Business overdraft facilities, used as a means of borrowing and a cash flow solution for a business, can be used instead of business loans as you are only paying for the balance of the overdraft that you are using rather than funds that have not been deployed as yet. This means that you are only paying for funds you have borrowed against the overdraft. Much like personal overdrafts, business overdrafts can be a really useful way of accessing a little extra working capital when your business needs cash quickly. From covering a late payment, paying an unexpected bill or simply helping cash flow, business overdrafts are a great short-term solution for businesses who need that extra safety net of funds.

Provide Finance helps you get the business overdraft credit facilities you want, fast. With access to over 200 approved lenders, all with competing rates and terms to secure your business overdraft credit facility business. We put your enquiry in front of a range of pre-approved providers where you can screen, shortlist and choose.

Start matching with lenders today.

Why Choose Us?

Speed

Instantly match with specialist lenders that are pre-qualified and ready to fund your plans.Access

Our platform gives you access to over 200 bespoke lending options, tailored to your requirements

Value

Our smart-search software means you’re guaranteed the best rates in the market. Plus, we don’t charge a broker fee.

Support

Monitor your enquiry in real-time, while receiving specialist support from our experience team of advisers.

Connect with over 200 trusted lenders

How It Works

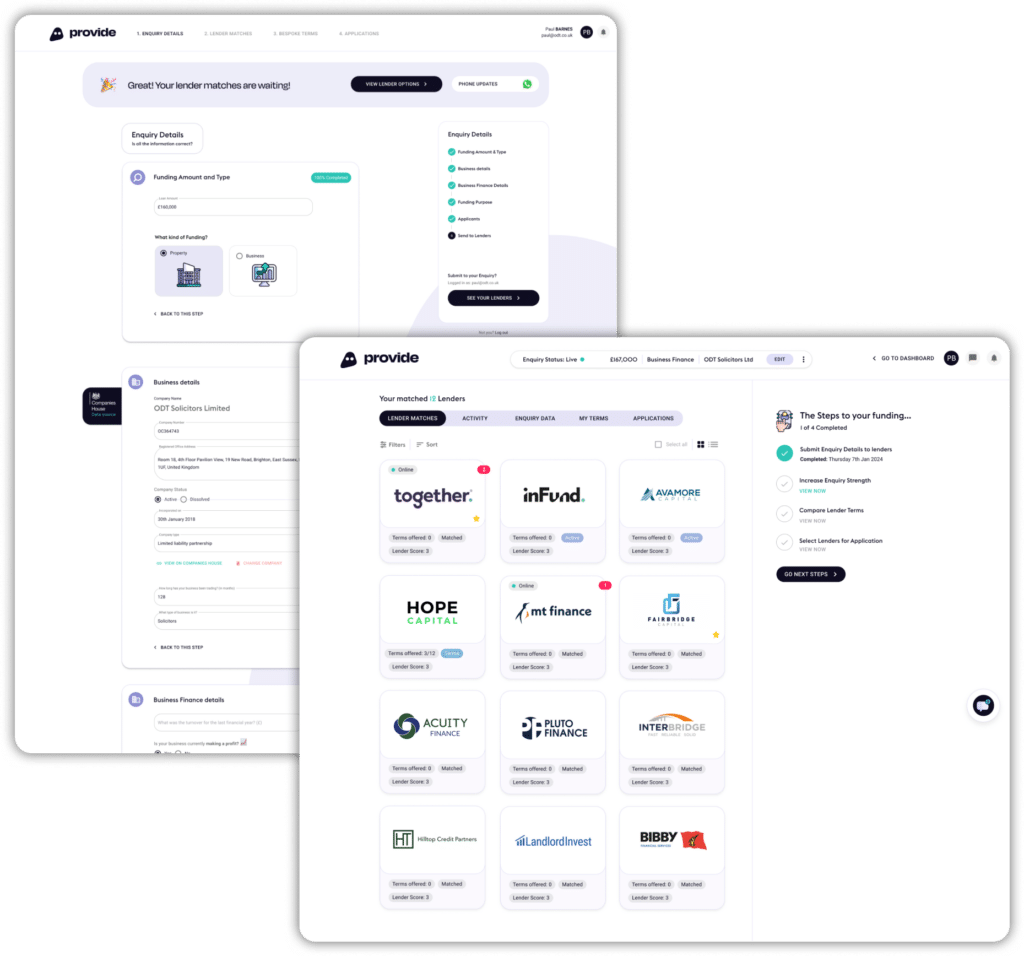

Submit Enquiry

Click ‘Match with Lenders‘ and submit your enquiry.

Matching Engine

Our software matches you with our specialist business finance lenders.

Connect With Lenders

Engage directly with our lenders and view your deals progress in real-time.

Chat To Support

We offer step-by-step support to help you get the best deal possible. Use our live chat, or call 0800 772 3180.

Together, We Go Far

At Provide Finance, we’re reshaping the future of business finance.

With our award-winning blend of innovation and expertise, we seamlessly connect borrowers, lenders, and intermediaries.

Our solutions are fast and cost-effective, providing you with transparency, control, and tailored support. With Provide Finance, you gain control through a real-time dashboard that tracks your project’s funding, enabling you to achieve your objectives with peace of mind. Provide Finance is dedicated to easing the complexities of specialist financing, to prioritise your success.

What Our Clients Say

Find Your Funding Now

Provide Finance instantly matches your enquiry with a highly targeted list of lenders, ready to finance your specific loan type. Compare, match and control your application, fully supported by our team of financial experts, today.

Access The Best Deals

* Average Loan Completion refers to our average bridging loan approval period.