UK House Prices Beyond the Chat

When it comes to UK house prices, it’s crucial to go beyond optimistic assumptions and mass media scaremongering. Instead, let’s analyse market insights using real data to gain a more objective perspective on the true value of the market. In this article, we will delve into the House Price Index (HPI), interpret market reports, analyse factors contributing to price declines, offer strategies for selling in challenging times, and highlight opportunities for buyers in a sluggish market.

Understanding and Interpreting the House Price Index (HPI):

To track changes in house prices over time, the House Price Index (HPI) serves as a crucial metric. By comparing sale prices of similar properties over a specific period, it provides valuable insights for homebuyers, sellers, and investors.

Market reports from various sources present a mixed picture of the current state of UK house prices. According to Gov.UK, positive growth is evident compared to the same time last year, with the average property in the UK valued at £286,489, representing a 3.5% increase. Similarly, Rightmove reports an overall upward movement of 1.1%, with a national average asking price of £372,812 in June.

In contrast, Halifax and Nationwide report negative trends, with annual average house price reductions of -1% and -3.4% respectively. Halifax’s average purchase price stands at £286,532, while Nationwide’s data shows an average house value of £260,736. These divergent reports highlight the complexity of interpreting and understanding market conditions.

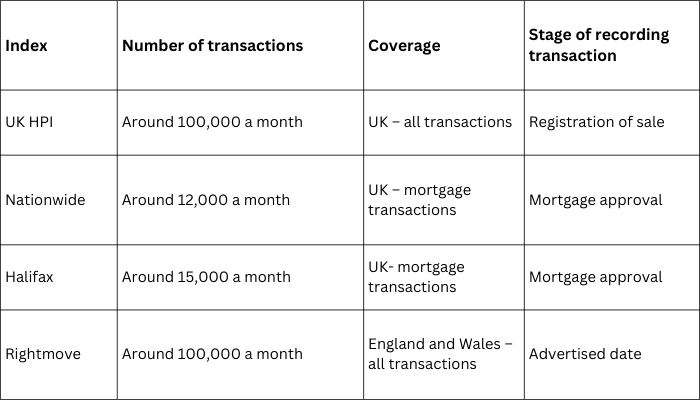

When comparing house price indices (HPIs) in the UK, it’s important to consider potential differences. Transaction reporting delays and varying transaction volumes can contribute to HPI variations. Additionally, indices like Halifax and Nationwide are based on smaller internal samples, which may affect their results. Being aware of these factors while analysing HPI data provides a more comprehensive understanding of the movement in house pricing.

The Signs of a Cooling Housing Market:

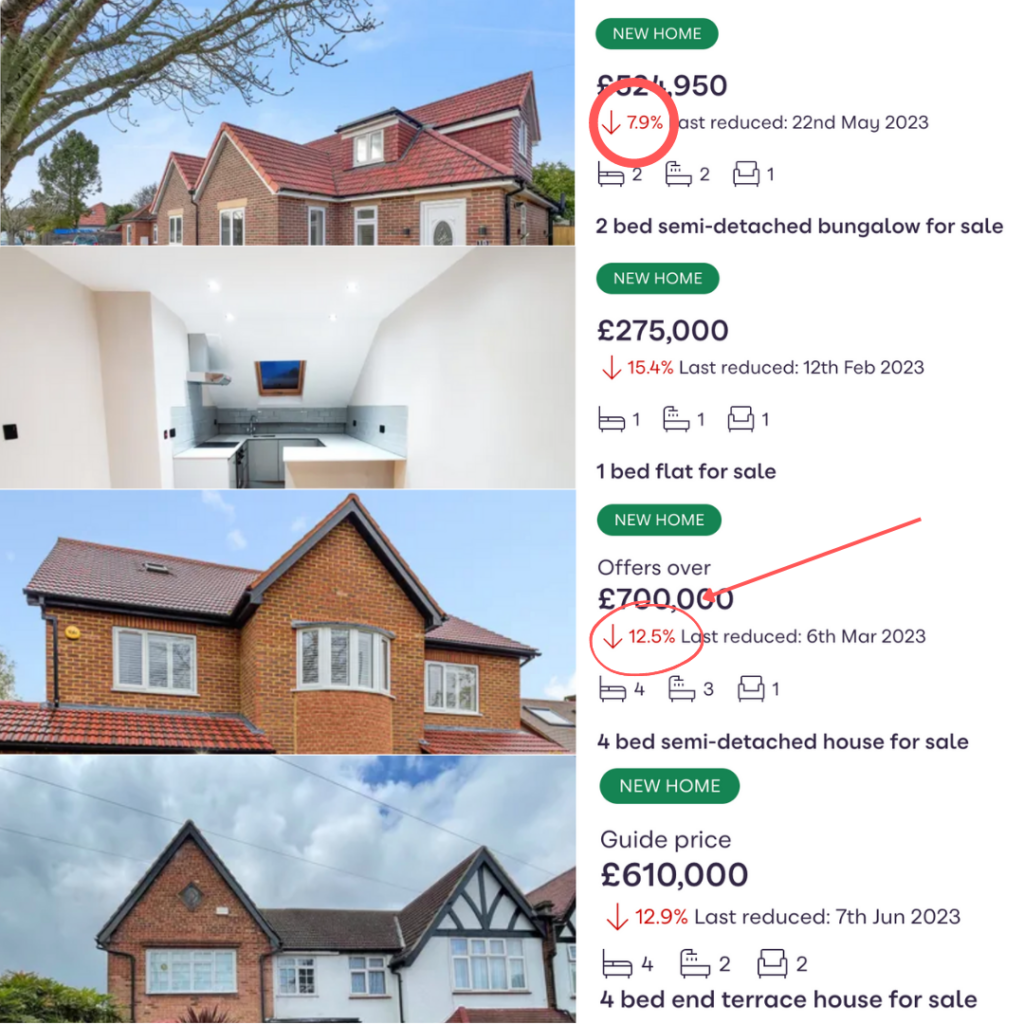

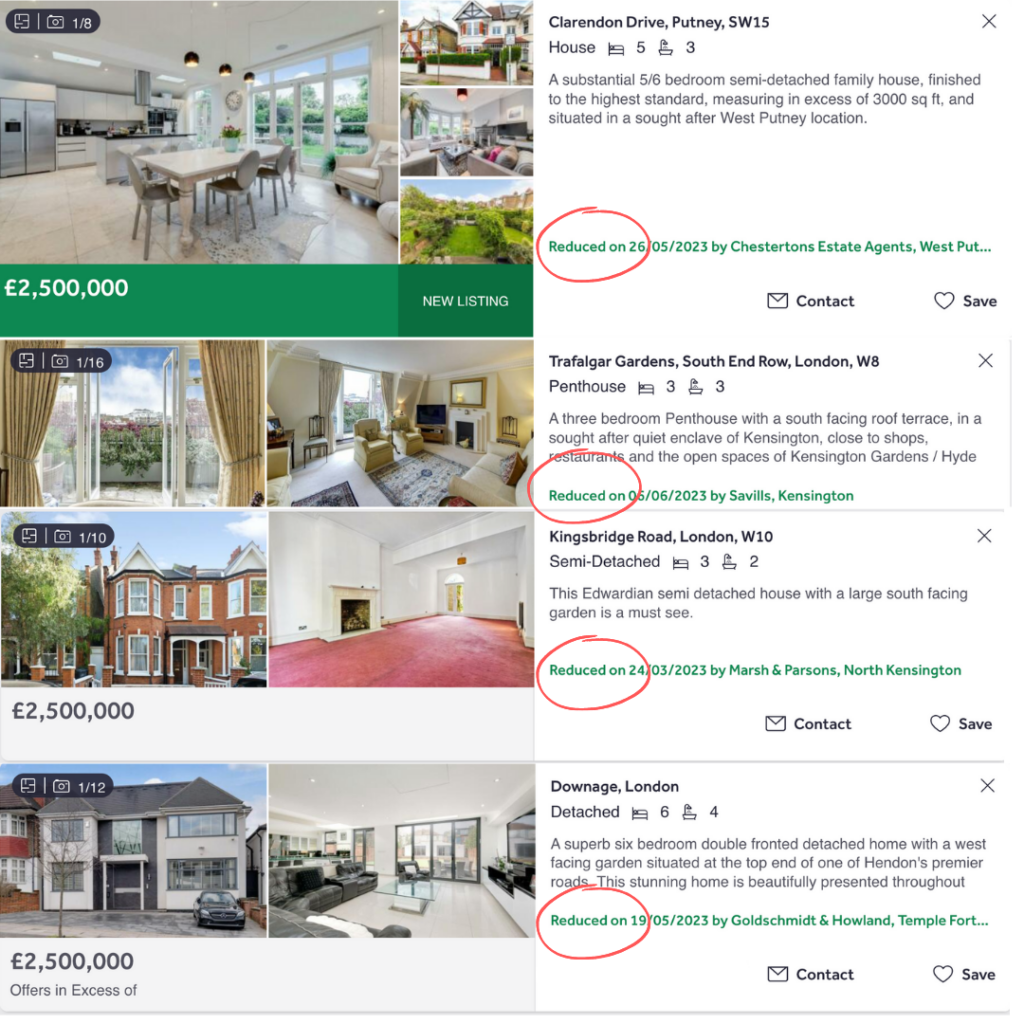

A visit to popular listings sites such as Zoopla and Rightmove reveals the presence of attractive property offerings with features like reduction notes or discount percentages. This suggests that we’ve entered a cooling-off period in the market as property owners anticipate the impact of mortgage rate increases.

Factors Influencing House Price Declines:

Several factors contribute to declining house prices, including pandemic monetary policies and war-driven supply chain disruptions causing a surge in inflation. To stabilise inflation, which currently sits at 8.7%, the Bank of England (BoE) has raised rates in hopes of achieving their target of 2% inflation. This rise in rates ultimately places homeowners under pressure to meet their mortgage obligations, leading to reductions in asking prices to unload their properties.

Considerations for Selling in Difficult Times:

For those looking to sell their properties, pricing competitively within the market context is essential. Dressing and staging your home are strongly suggested to homeowners trying to sell, especially in a highly competitive market. By renting beautiful interiors or keeping existing furniture in the home, you can help potential buyers visualise how the space can be utilised and transform it from an empty shell into a welcoming, liveable home.

Creating an attractive and well-organised living environment significantly increases the perceived value of your property and attracts more potential buyers. Despite higher mortgage rates and dampened demand, it’s crucial to highlight the unique features of your home, such as its location, size, and amenities.

A Buyer’s Opportunity in a Sluggish Market:

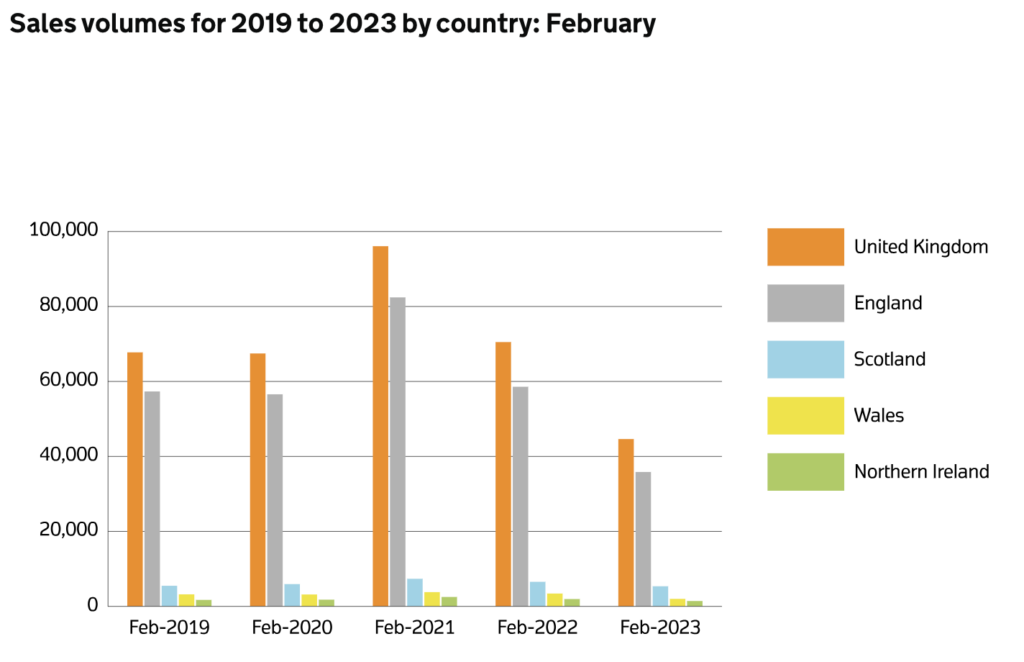

Graphs from Gov.UK indicate a slowdown in sales volume, signalling that buyers are taking their time to assess the market. This presents a favourable opportunity for cash-rich buyers seeking to expand their portfolio, be it through Buy-to-Let or Semi-Commercial conversions.

Following Warren Buffet’s philosophy of being greedy when others are fearful, investors are strongly considering the upside potential of these lower prices before rates stabilise. This provides the chance to remortgage and access greater equity at a later stage, especially if you buy and renovate to add value.

Navigating the current housing market conditions requires careful consideration of various factors, including legal fees, agent involvement, product transfers, and higher mortgage rates. Assessing affordability, setting clear objectives, conducting thorough research, cultivating relationships with lenders, and implementing sustainable action plans are paramount.

At Provide Finance, we understand the implications of overwhelming interest rate movements and their effects on house prices. With our extensive network of over 200 connected lenders, our team of advisers is ready to alleviate your concerns and provide clarity during any challenges you may face.

In summary, whether you’re a homeowner or a potential buyer, seeking informed assistance is crucial for making sound decisions amidst market downturns. By embracing foresight and market understanding, you can navigate the housing sector with confidence.

Together, we go far!