Bridging Loan for Property Developers

If your project requires speed and flexibility, let Provide Finance get the best Bridging loan for property developers to support your residential or commercial development project.

Match With Lenders Today

Match With Lenders Today

200+ Lenders

Specialist Advice

Online Support

Best Rates

Property Development Finance With Provide Finance

Property Development Finance applies to developing or renovating large-scale properties. Within Property Development Finance there are an array of finance options available depending on the project; mortgages, commercial property refurbishment loans, bridging loans, and personal loans could all fall into this category.

Developing property for resale or to keep and maintain as an investment is a great way to generate further income. However, UK real estate development can be costly, and many potential developers lack sufficient funds to pay in cash.

Unlike long-term property mortgages, development financing is typically short-term, with lifecycles in the range of 6-24 months. Loans can be used to buy land and pay for construction costs, and securing the right Bridging loan for property developers in UK is essential for ground-up new builds, conversions or refurbishments of existing properties.

Provide Finance helps you get the right development finance you want, fast. With access to over 200 approved lenders, all with competing rates and terms to secure your business, we can put your enquiry in front of a range of pre-approved lenders where you can screen, shortlist and choose. Start matching today.

Getting the right Bridging loan for property developers in UK can unlock time-sensitive opportunities, like auction property finance, ensuring your project gets underway immediately.

Why Choose Us?

Speed

Instantly match with specialist lenders that are pre-qualified and ready to fund your plans.Access

Our platform gives you access to over 200 bespoke lending options, tailored to your requirements

Value

Our smart-search software means you’re guaranteed the best rates in the market. Plus, we don’t charge a broker fee.

Support

Monitor your enquiry in real-time, while receiving specialist support from our expert team of advisers.

Connect with over 200 trusted lenders

How It Works

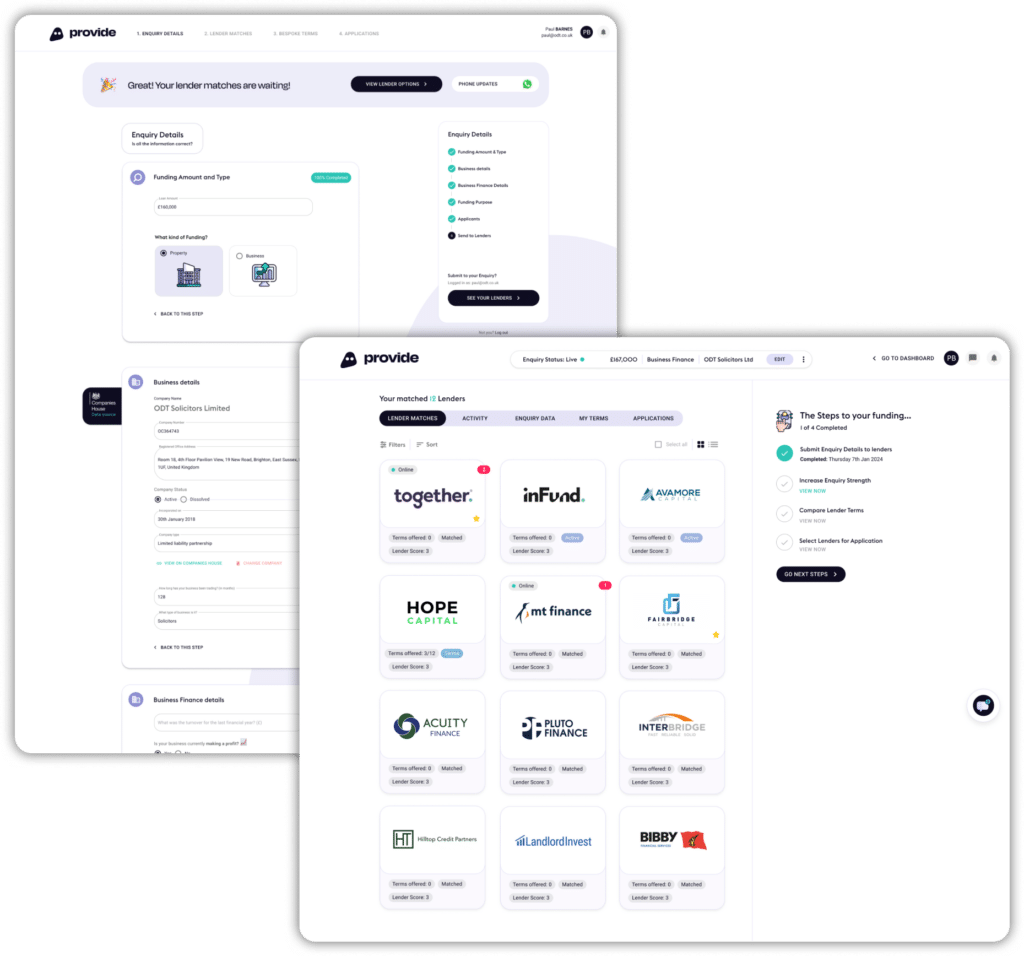

1.Submit Enquiry

Click ‘Match with Lenders‘ and submit your enquiry.

2.Matching Engine

Our software matches you with our specialist business finance lenders.

3.Connect With Lenders

Engage directly with our lenders and view your deals progress in real-time.

4.Chat To Support

We offer step-by-step support to help you get the best deal possible. Use our live chat, or call 0800 772 3180.

Together, We Go Far

At Provide Finance, we’re reshaping the future of property development finance by offering specialized funding, including the best options for a Bridging loan for property developers in UK.

With our award-winning blend of innovation and expertise, we seamlessly connect borrowers, lenders, and intermediaries. Our solutions are fast and cost-effective, providing you with transparency, control, and tailored support.

With Provide Finance, you gain control through a real-time dashboard that tracks your project’s funding, enabling you to achieve your objectives with peace of mind.

Provide Finance is dedicated to easing the complexities of specialist financing, to prioritise your success, and ensure every Bridging loan for property developers we arrange is perfectly tailored.

What Our Clients Say

Frequently Asked Questions (FAQs)

About Commercial Bridging Finance & Loans in the UK

The primary benefit is speed and flexibility. A specialized Bridging loan for property developers in UK is designed for time-sensitive deals, like auctions or quick acquisitions. Unlike traditional banks, these short-term solutions are secured against the property (or land) and focus on the project’s profitability rather than the developer’s income alone. This allows for rapid funding—often in weeks—which is essential in the fast-paced UK property market. Provide Finance is an appointed representative operating within the guidelines of the Financial Conduct Authority (FCA) register.

Commercial Property Refurbishment Loans are short-term finance specifically designed to add value to an existing commercial asset before selling or refinancing. These loans can cover both light and heavy work:

Light Refurbishment: Focuses on cosmetic changes like redecorating, new fittings, or simple renovations that do not require planning permission.

Heavy Refurbishment: Involves structural work, extensions, or a change of use (e.g., converting offices to flats), which does require building regulations and planning consent.

The loan funds can cover the property purchase price and up to $\mathbf{100\%}$ of the planned refurbishment costs.

Yes, absolutely. This is one of the most common uses of bridging finance. We specifically arrange commercial property refurbishment loans designed to cover the purchase price, the cost of the renovation work (often through drawdowns), and the interest payments. These loans are perfect for quickly upgrading an office, retail unit, or mixed-use building before selling or refinancing.

Approval for Property Development Finance relies heavily on the quality and viability of your project. Lenders typically require a clear Exit Strategy (your plan to repay the loan, usually through selling or refinancing the finished project), demonstrable developer experience, a detailed financial appraisal, and clarity on planning permission and projected Gross Development Value (GDV).

Speed is the greatest advantage of auction property finance. Since most UK property auctions require completion within 28 days, traditional lending is not viable. Provide Finance prioritizes these urgent applications, often working to secure and process the funds in as little as 10 to 14 days to ensure you meet the strict deadline and avoid losing your deposit. RICS Consumer Guide on Property Auctions

The term for a Bridging loan for property developers in UK is typically short-term, ranging from 3 to 24 months. The most common ‘Exit Strategies’ involve either selling the developed property once the project is complete, or refinancing onto a longer-term commercial mortgage once the property is habitable and rentable. A solid, verifiable exit plan is the single most important factor for securing a bridging loan.

Find Your Funding Now

Provide Finance instantly matches your enquiry with a highly targeted list of lenders, ready to finance your specific loan type. Compare, match and control your application, fully supported by our team of financial experts, today.

Access The Best Deals

* Average Loan Completion refers to our average bridging loan approval period.